Best Way to Buy a House With Little Down

Can you buy a firm with no money down?

A no–down–payment mortgage allows first–time habitation buyers and repeat domicile buyers to purchase property with no money required at closing, except standard closing costs.

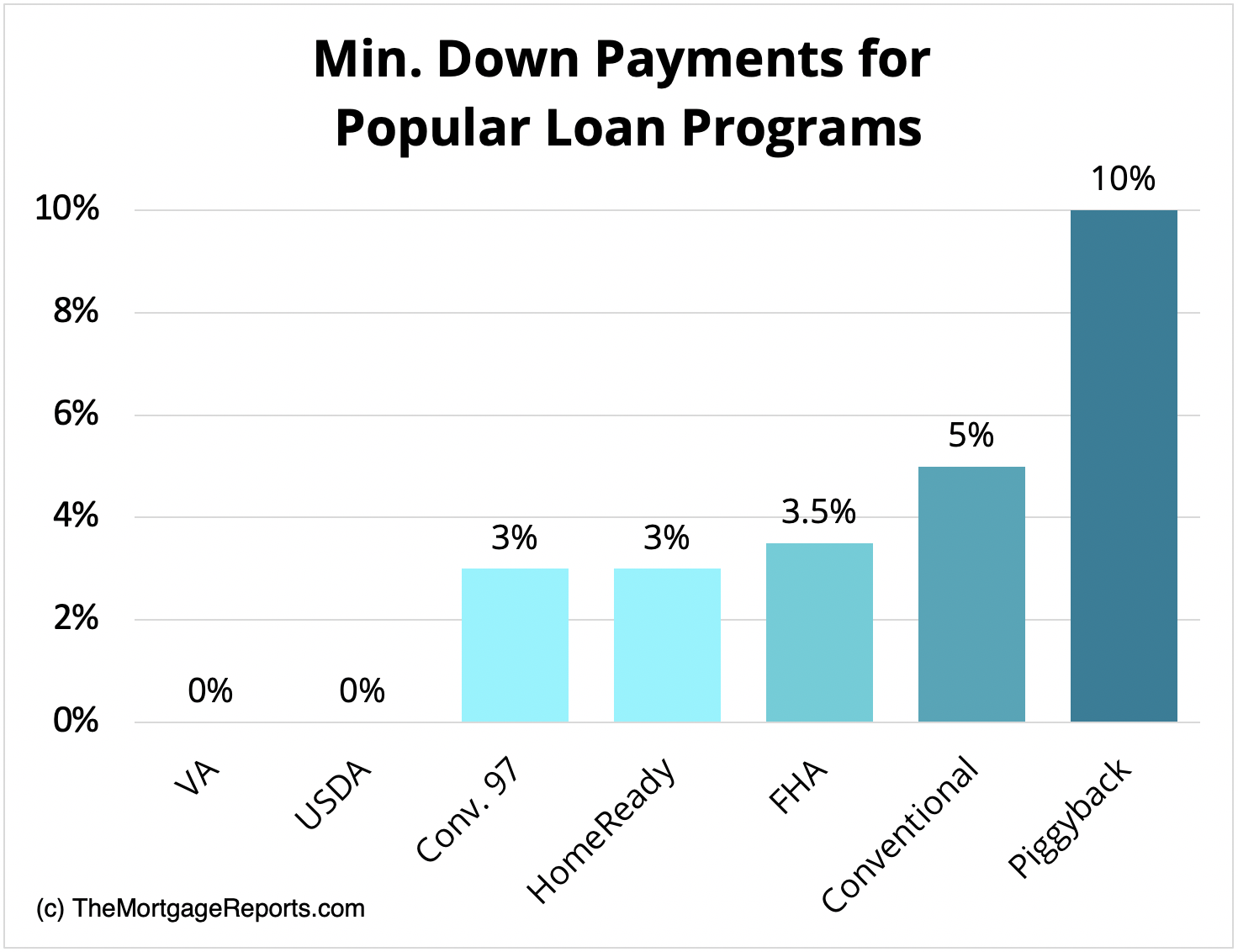

Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loan, offer depression down payment options with a piffling as 3% downwardly. Mortgage insurance premiums typically accompany low and no downwards payment mortgages, but not always.

Furthermore, mortgage rates are still depression.

Rates for xxx–yr loans, 15–yr loans, and 5–year Artillery are historically cheap, which has lowered the monthly price of owning a abode.

Click to run into your Naught down eligibility (Feb 20th, 2022)In this article (Skip to...)

- Buying with no money

- USDA loans (0% down)

- VA loans (0% down)

- FHA loans (iii.v% downwards)

- HomeReady loan (three% down)

- Conventional 97 (3% downward)

- Conventional (v% down)

- Piggyback Loan (10% down)

- Should you put 20% down?

- Down payment FAQ

How to purchase a firm with no coin

If you want to buy a firm with no money, in that location are two big expenses you lot'll need covered: the down payment and closing costs. Both tin be avoided if you authorize for a null–down mortgage and/or a abode buyer assistance program.

Five strategies to purchase a firm with no coin include:

- Apply for a nada–downward VA loan or USDA loan

- Use downwards payment assistance to comprehend the down payment

- Inquire for a down payment gift from a family fellow member

- Get the lender to pay your closing costs ("lender credits")

- Go the seller to pay your closing costs ("seller concessions")

When combined, these tactics could put you in a new dwelling with $0 out of pocket.

Or y'all might get your downward payment covered, and then you'd only demand to pay closing costs out of pocket – which could reduce your cash requirement by thousands.

Verify your depression- or no-money-downward eligibility (Feb 20th, 2022)First–fourth dimension habitation buyer loans with zilch downwards

At that place are just two major loan programs with aught down: the USDA loan and the VA loan. Both are available to commencement–time home buyers and repeat buyers alike. Just they have special eligibility requirements to qualify.

No down payment: USDA loans (100% financing)

The U.S. Department of Agronomics offers a 100% financing mortgage. The program is known as the 'Rural Housing Loan' or just 'USDA loan.'

The proficient news well-nigh the USDA Rural Housing Loan is that it's not just a "rural loan" – it's bachelor to buyers in suburban neighborhoods, also. The USDA'southward goal is to assistance "low–to–moderate income homebuyers," wherever they may be.

Many borrowers using the USDA loan program brand a practiced living and reside in neighborhoods that don't meet the traditional definition of a 'rural area.'

Some key benefits of the USDA loan are:

- No down payment requirement

- No maximum dwelling house purchase price

- Below–market interest rates

- The upfront guarantee fee can be added to the loan balance at closing

- Monthly mortgage insurance fees are cheaper than for FHA

But be aware that USDA enforces income limits; your household income must be about or beneath the median for your area.

Another key do good is that USDA mortgage rates are often lower than rates for comparable low– or no– down–payment mortgages. Financing a home via USDA tin can be the everyman–cost path to homeownership.

Bank check my USDA eligibility (February 20th, 2022)No down payment: VA loans (100% financing)

The VA loan is a no–downward–payment mortgage bachelor to members of the U.S. military, veterans, and surviving spouses.

VA loans are backed by the U.S. Department of Veterans Affairs. That means they have lower rates and easier requirements for borrowers who run across VA mortgage guidelines.

VA loan qualifications are straightforward.

Nigh veterans, active–duty service members, and honorably discharged service personnel are eligible for the VA program. In add-on, home buyers who take spent at least half-dozen years in the Reserves or National Guard are eligible, as are spouses of service members killed in the line of duty.

Some primal benefits of the VA loan are:

- No down payment requirement

- Flexible credit score minimums

- Beneath–market mortgage rates

- Bankruptcy and other derogatory credit information does not immediately disqualify you

- No mortgage insurance is required, merely a one–fourth dimension funding fee which can be included in the loan corporeality

In addition, VA loans accept no maximum loan corporeality. It's possible to get a VA loan above electric current befitting loan limits, as long equally you accept strong enough credit and you can afford the payments.

Check my VA loan eligibility (Feb 20th, 2022)Low downwards payment first–time dwelling heir-apparent loans

Not anybody volition qualify for a zero–down mortgage. But it may still exist possible to purchase a firm with no money down past choosing a low–downward–payment mortgage and using an assistance program to cover your upfront costs.

If you want to go this road, hither are a few of the best low–money–down mortgages to consider.

Low down payment: FHA loans (3.v% down)

The 'FHA mortgage' is a bit of a misnomer considering the Federal Housing Administration (FHA) doesn't really lend coin.

Rather, the FHA sets basic lending requirements and insures these loans one time they're made. The loans themselves are offered by most all private mortgage lenders.

FHA mortgage guidelines are famous for their liberal approach to credit scores and down payments.

The FHA will typically insure home loans for borrowers with low credit scores, and then long as there'due south a reasonable explanation for the low FICO.

FHA also allows a downwardly payment of but 3.5% in all U.S. markets, with the exception of a few FHA approved condos.

Other benefits of an FHA loan are:

- Your down payment may come entirely from gift funds or down payment assistance

- The minimum credit score is 500 with a 10% downwards payment, or 580 with a iii.five% down payment

- Upfront mortgage insurance premiums can exist included in the loan amount

Furthermore, the FHA can sometimes help homeowners who have experienced recent short sales, foreclosures, or bankruptcies.

The FHA insures loan sizes up to $ in designated "high–price" areas nationwide. High–price areas include places like Orange Canton, California; the Washington D.C. metro area; and, New York Metropolis's 5 boroughs.

Note that if you desire to use an FHA loan, the home beingness purchased must be your primary residence. This program isn't intended for vacation homes or investment properties.

Click to run across your 3.5% down FHA eligibility (February 20th, 2022)Low downward payment: The HomeReady Mortgage (iii% downwardly)

The HomeReady mortgage is special among today'due south low– and no–down–payment mortgages.

Backed by Fannie Mae and bachelor from almost every U.S. lender, the HomeReady mortgage offers below–market place mortgage rates, reduced private mortgage insurance (PMI) costs, and innovative underwriting for lower–income dwelling buyers.

Via HomeReady, the income of everybody living in the home tin be used to become mortgage–qualified and canonical.

For example, if you lot are a homeowner living with your parents, and your parents earn an income, you lot can employ their income to help you qualify.

The HomeReady program also lets you use boarder income to help authorize, and y'all can utilise income from a non–zoned rental unit, too – even if yous're paid in cash.

HomeReady home loans were designed to help multi–generational households get approved for mortgage financing. However, the program can be used by anyone in a qualifying area, or who meets household income requirements.

Freddie Mac offers a similar programme, chosen Dwelling Possible, which is also worth a look.

Home Possible is a fiddling less flexible near income qualification than HomeReady. But it offers many similar benefits, including a minimum 3% down payment.

Click to see your 3% down eligibility (Feb 20th, 2022)Low down payment: Conventional loan 97 (3% downward)

The Conventional 97 plan is available from Fannie Mae and Freddie Mac. It'south a 3% downward payment program and, for many dwelling house buyers, it'southward a less expensive loan option than an FHA mortgage.

Bones qualification requirements for a Conventional 97 loan include:

- Loan size may non exceed $, even if the home is in a high–cost market

- The property must be a unmarried–unit habitation. No multi–unit homes are allowed

- The mortgage must be a fixed–rate mortgage. No adjustable–rate mortgages are immune via the Conventional 97

The Conventional 97 programme does not enforce a specific minimum credit score beyond those for a typical conventional home loan. The program tin can be used to refinance a home loan, too.

In addition, the Conventional 97 mortgage allows for the entire 3% down payment to come from gifted funds, and then long as the gifter is related by blood or marriage, legal guardianship, domestic partnership, or is a fiance/fiancee.

Low downwardly payment: Conventional mortgage (5% down)

Conventional 97 loans are a lilliputian more than restrictive than 'standard' conventional loans, because they're intended for kickoff–time home buyers who demand extra help qualifying.

If you don't meet the guidelines for a Conventional 97 loan, you can salve upwardly a little more than and try for a standard conventional mortgage.

Conventional mortgages are the nigh popular loan blazon in the market considering they're incredibly flexible. You lot can brand a down payment as depression as v% or as big as 20%. And you simply need a 620 credit score to authorize in many cases.

Plus, conventional loan limits are higher than FHA loan limits. So if your purchase price exceeds FHA'south limit, you might want to save up 5% and try for a conventional loan instead.

Conventional mortgages with less than xx% down require individual mortgage insurance (PMI). But this can be canceled once you have 20 percent equity in the home. And so you're not stuck with the additional fee forever.

Verify your conventional loan eligibility (Feb 20th, 2022)Low down payment: The "Piggyback Loan" (ten% down)

1 final option if you want to put less than 20% down on a house – simply don't want to pay mortgage insurance – is a piggyback loan.

The "piggyback loan" or "80/x/10" plan is typically reserved for buyers with above–average credit scores. Information technology's actually 2loans, meant to give home buyers added flexibility and lower overall payments.

The beauty of the lxxx/10/10 is its structure.

- With an eighty/10/10 loan, buyers bring a 10% downwards payment to closing

- They also get a 10% second mortgage (HEL or HELOC)

- This leaves an 80% mortgage loan

- Since you're effectively putting 20% downwards, there is no PMI

The first mortgage is typically a conventional loan via Fannie Mae or Freddie Mac, and it's offered at current market mortgage rates.

The second mortgage is a loan for 10% of the dwelling'south purchase price. This loan is typically a home equity loan (HEL) or domicile equity line of credit (HELOC).

And that leaves the concluding "10," which represents the buyer'south down payment amount – 10% of the buy price. This amount is paid as cash at closing.

This blazon of loan structure can help you avert individual mortgage insurance, lower your monthly mortgage payments, or avoid a colossal loan if you're right on the cusp of conforming loan limits.

However, y'all'll typically need a credit score of 680–700 or higher to qualify for the second mortgage. And you'll have two monthly payments instead of 1.

If you're interested in a piggyback mortgage, hash out pricing and eligibility with a lender. Brand certain yous're getting the most affordable habitation loan overall – month–to–calendar month and in the long term.

Click to see your low-downpayment loan eligibility (February 20th, 2022)Domicile buyers don't need to put xx% down

Information technology'south a common misconception that "20 percent down" is required to buy a abode. And, while that may have true at some signal in history, it hasn't been so since the appearance of the FHA loan in 1934.

In today's existent manor market, home buyers don't need to make a xx% downwards payment. Many believe that they exercise, however – despite the obvious risks.

The likely reason buyers believe 20% downward is required is because, without xx percentage, you lot'll have to pay for mortgage insurance. Only that'southward not necessarily a bad thing.

PMI is non evil

Private mortgage insurance (PMI) is neither good nor bad, simply many dwelling house buyers yet try to avoid it at all costs.

The purpose of private mortgage insurance is to protect the lender in the event of foreclosure – that'south all it'south for. However, because it costs homeowners coin, PMI gets a bad rap.

It shouldn't.

Considering of individual mortgage insurance, home buyers tin get mortgage–canonical with less than 20% down. And, eventually, private mortgage insurance tin be removed.

At the charge per unit today's domicile values are increasing, a heir-apparent putting iii% downward might pay PMI for fewer than iv years.

That'southward not long at all. Yet many buyers – especially first–timers – will put off a purchase because they want to relieve upwardly twenty pct.

Meanwhile, dwelling values are climbing.

For today'south home buyers, the size of the downwardly payment shouldn't be the only consideration.

This is because home affordability is not about the size of your down payment – it's about whether you can manage the monthly payments and still have cash left over for "life."

A large downward payment will lower your loan amount, and therefore will give you a smaller monthly mortgage payment. However, if you lot've depleted your life savings in lodge to make that large downwards payment, you've put yourself at risk.

Don't deplete your entire savings

When the majority of your money is tied upward in a abode, fiscal experts refer to it every bit being "house–poor."

When y'all're firm–poor, you accept plenty of money on paper only little cash bachelor for everyday living expenses and emergencies.

And, as every homeowner volition tell you, emergencies happen.

Roofs collapse, water heaters intermission, you lot become sick and cannot work. Insurance can help yous with these issues sometimes, but not ever.

That's why being house–poor is then dangerous.

Many people believe it's financially bourgeois to put 20% downward on a home. If 20% is all the savings you have, though, using the full corporeality for a downward payment is the contrary of being financially conservative.

The true financially conservative selection is to make a small down payment and leave yourself with some coin in the bank. Being house–poor is no fashion to live.

Click to come across your Naught down eligibility (Feb 20th, 2022)Mortgage downwardly payment FAQ

Here are answers to some of the well-nigh often asked questions about mortgage down payments.

What is the minimum downwardly payment for a mortgage?

The minimum down payment varies by mortgage plan. VA and USDA loans let aught down payment. Conventional loans commencement at 3 percent down. And FHA loans require at least 3.5 percent downwards. Y'all are free to contribute more the minimum downward payment amount if you want.

Are in that location cypher-down mortgage loans?

There are just ii first–fourth dimension home buyer loans with zero down. These are the VA loan (backed by the U.S. Section of Veterans Affairs) and the USDA loan (backed by the U.Southward. Department of Agronomics). Eligible borrowers tin buy a business firm with no money down only will even so have to pay for closing costs.

How tin can I purchase a house with no money down?

In that location are two ways to purchase a business firm with no money downwards. One is to become a zero–downwardly USDA or VA mortgage if you authorize. The other is to get a depression–downwards–payment mortgage and comprehend your upfront price using a down payment aid programme. FHA and conventional loans are available with just 3 or iii.5 percent down, and that entire amount could come from down payment assistance or a cash gift.

What credit score exercise I need to buy a house with no money down?

The no–money–down USDA loan program typically requires a credit score of at least 640. Another no–money–down mortgage, the VA loan, allows credit scores as depression every bit 580–620. But you must be a veteran or service member to qualify.

What are down payment aid programs?

Downward payment assistance programs are available to domicile buyers nationwide, and many showtime–time dwelling buyers are eligible. DPA tin come in the form of a home buyer grant or a loan that covers your downwards payment and/or closing costs. Programs vary by state, so be sure to inquire your mortgage lender which programs you may be eligible for.

Are at that place any home buyer grants?

Abode buyer grants are offered in every state, and all U.S. dwelling house buyers can apply. These are also known as down payment assistance (DPA) programs. DPA programs are widely available but seldom used – many domicile buyers don't know they exist. Eligibility requirements typically include having depression income and a decent credit score. But guidelines vary a lot by program.

Can greenbacks gifts be used as a downward payment?

Yeah, cash gifts can be used for a downwards payment on a home. But you must follow your lender'southward procedures when receiving a cash gift. First, make sure the gift is made using a personal check, a cashier's check, or a wire. Second, continue newspaper records of the souvenir, including photocopies of the checks and of your deposit to the banking company. And brand certain your deposit matches the amount of the souvenir exactly. Your lender will also want to verify that the gift is really a gift and not a loan in disguise. Cash gifts must not require repayment.

What are FHA loan requirements?

FHA loans typically crave a credit score of 580 or higher and a 3.5 percent minimum down payment. You will also need a stable income and two–year employment history verified by Due west–two statements and paystubs, or by federal tax returns if cocky–employed. The home y'all're purchasing must exist a main residence with 1–four units that passes an FHA home appraisement. And your loan amount cannot exceed local FHA loan limits. Finally, you cannot have a recent bankruptcy, foreclosure, or short sale.

What are the benefits of putting more money downwards?

Just as at that place are benefits to depression– and no–money–downwardly mortgages, there are benefits to putting more money downwardly on a home purchase. For example, more money downwardly ways a smaller loan amount – which reduces your monthly mortgage payment. Additionally, if your loan requires mortgage insurance, with more money down, your mortgage insurance will exist removed in fewer years.

If I make a depression down payment, do I pay mortgage insurance?

Mortgage insurance is typically required with less than 20 per centum down, but not e'er. For example, the VA Home Loan Guaranty program doesn't require mortgage insurance, so making a low down payment won't matter. Conversely, FHA and USDA loans alwaysrequire mortgage insurance. So even with big downwards payments, you'll have a monthly MI charge. The only loan for which your downwardly payment amount affects your mortgage insurance is the conventional mortgage. The smaller your downwardly payment, the higher your monthly PMI. Withal, once your home has 20 percent disinterestedness, you'll exist eligible to have your PMI removed.

If I make a depression downward payment, what are my lender fees?

Lender fees are typically adamant as a pct of your loan amount. For instance, the loan origination fee might be 1 pct of your mortgage remainder. The bigger your down payment, the lower your loan corporeality will exist. So putting more than money down can help lower your lender fees. Just you lot'll withal accept to bring more greenbacks to the closing table in the course of a down payment.

How tin I fund a down payment?

A downward payment can be funded in multiple ways, and lenders are oftentimes flexible. Some of the more common ways to fund a down payment are to use your savings or checking business relationship, or, for repeat buyers, the proceeds from the auction of your existing home.

However, there are other ways to fund a down payment, likewise.

For instance, abode buyers can receive a greenbacks souvenir for their down payment or infringe from their 401k or IRA (although that's not always wise).

Down payment assistance programs can fund a down payment, too. Typically, down payment help programs loan or grant money to home buyers with the stipulation that they live in the home for a sure number of years – often 5 years or longer.

Regardless of how you fund your down payment, brand sure to continue a paper trail. Without a clear account of the source of your downwardly payment, a mortgage lender may non allow its use.

How much home tin can I beget?

The respond to the question "How much dwelling house tin can I afford?" is a personal one and should not be left solely to your mortgage lender.

The best mode to decide how much house you can beget is to start with your monthly upkeep and decide what you tin comfortably pay for a dwelling house each month.

And then, using your desired payment as the starting point, use a mortgage estimator and work backward to detect your maximum home buy price.

Note that today'south mortgage rates volition impact your mortgage calculations, then be sure to utilize electric current mortgage rates in your estimate. When mortgage rates modify, so does home affordability.

What are today'south low–down–payment mortgage rates?

Today'southward mortgage rates are low across the lath. And many depression–down–payment mortgages have below–market rates thanks to their government backing; these include FHA loans (three.five% down) and VA and USDA loans (0% down).

Dissimilar lenders offering different rates, then you'll want to compare a few mortgage offers to find the all-time deal on your low– or no–down–payment mortgage. You can get started correct hither.

Testify me today's rates (Feb 20th, 2022)

The information independent on The Mortgage Reports website is for advisory purposes just and is not an advertizing for products offered past Full Beaker. The views and opinions expressed herein are those of the writer and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

patrickforrincell.blogspot.com

Source: https://themortgagereports.com/11306/buy-a-home-with-a-low-downpayment-or-no-downpayment-at-all

Post a Comment for "Best Way to Buy a House With Little Down"